- Home

- Speakeasy

Where Do We Begin?

by David Atwood Where do we begin is first answered by acknowledging gratitude. Clients who put their trust and confidence in us over the past 35 years gave us our reason for being. We have experienced significant market events like this in 1987, 1990, 1999, 2002, 2008 and now 2020 with many smaller corrections along […]

Sticker Shock

by David Atwood This past year was the ‘worst’ year for investors since the great financial crisis of 2008. The Canadian TSX index finished down 10.1% on the year and the Canadian dollar was among the worst performing major currencies in the world. Volatility returned to stock markets around the world and the last quarter […]

Sophistication made Simple

by David Atwood “All intelligent investing is value investing – to acquire more than you are paying for.” Charlie Munger Fans of any challenging pursuit appreciate reducing the complexities down to the simple and obvious. Warren Buffett, Munger’s business partner, is known for distilling financial complexity into down to earth simplicity. Buffett is often quoted […]

Warren Buffett Archives

Warren Buffett Archive CNBC has compiled a comprehensive archive of all good things related to Buffett. Find anything from past Berkshire Hathaway Annual General Meetings to news articles and hundreds of hours of searchable video. Find the Warren Buffett Archive from CNBC here – https://buffett.cnbc.com/

Are We There Yet?

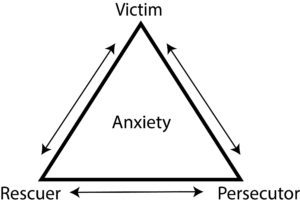

Adventures of the Intrepid Investor by David Atwood February 8, 2018 After a roaring start to 2018, equity markets are reminding investors that price swings are an inherent part of investing. There are those who are surprised by the spectacle of falling prices and stop in their tracks, looking up together to see if […]

Back to School Checklist

MyTalisman – Live the Life You Love! Logging flights as a student pilot taught me the importance of following a checklist. When everything is going as expected, its easy to become complacent and to overlook something important. Confirming there is adequate fuel for the flight and the weight of the load comes to mind. Financial […]

Talisman 2016 Annual Report

Growth and Service Milestones Welcome to the opening weeks of 2017 and the 1st day of the rest of your life! Thank you for sharing this important part of your journey with us here at Talisman. Some of our best clients have decades of experience investing with us and they have witnessed quite a transformation […]

Elizabeth Warren

Elizabeth Warren Video Watch Senator Elizabeth Warren speak out on behalf of those without a voice. A giant, Wells Fargo and CEO John Stumph, is called out for cross selling to unsuspecting victims, blaming thousands of front line staff, and for pocketing hundreds of millions in compensation. The result – a giant takes a knee and a win for […]

Interest Rates Lower Than the Belly of a Snake

Low interest rates are the spawning ground for a number of different economic shifts and upheavals. The more obvious examples are the impact on savers, largely those pensioners who may have been relying on rates in the mid single digits or higher. Many retirees may have thought they had enough savings to carry them through […]